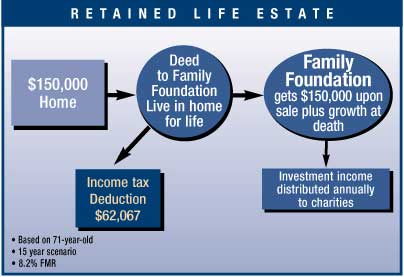

Many people plan to leave their homes to a charity in their wills. Naturally, they can’t make those gifts now because they need their homes. You can now leave your home or farm to your own family foundation account and retain the right to live there for your life (the life of your surviving spouse or other person can also be added). You get a sizable current charitable income tax deduction. The tax deduction is taken the year the property is donated based on the appraised amount and may be carried over for five additional years. The amount of your tax savings depends on your age and the value of your home. A gift of your home now, with retained life residency for you, gives you the same estate tax benefit as a gift by will. In addition, you save probate costs and receive an estate tax deduction. Similar tax benefits are allowed for a gift of your farm, and you retain the right to use the farm for your life (and to have a survivor use it for life, if you like).